How Much Does Payroll Service Cost?

Plus 5 FREE Payroll Services

In today’s fast-paced business world, managing payroll effectively and efficiently has become a crucial aspect of any successful organization. With the rise of digital solutions, online payroll services have emerged as a powerful tool for businesses of all sizes, offering streamlined processes, automated calculations, and compliance with tax laws. However, one of the most pressing questions for any business considering these services is: How much do they cost?

Featured Payroll Companies

Rippling

Paycor

Paychex

Gusto

Compare Payroll Costs by Provider

Now, let’s delve into the pricing structures of some of the leading online payroll service providers, including SurePayroll, Paycom, Gusto, ADP, QuickBooks, Paychex, Paycor, and Rippling. By comparing their pricing models and additional features, we aim to provide a comprehensive overview that can guide businesses in making an informed decision about which service best suits their payroll needs and budget constraints. Whether you’re a small start-up or a large corporation, understanding the cost implications of these services is vital for efficient financial planning and management. Let’s explore what each of these providers has to offer, and listed below. You’ll also find five free payroll service options available when you sign up.

QuickBooks Cost:

Offers three plans for QuickBooks Online Payroll: Core ($45 per month), Premium ($75 per month), and Elite ($125 per month), plus a per-employee charge of $4, $8, and $10 respectively. QuickBooks Enhanced Payroll for QuickBooks Desktop users is available at $50 per month, plus $2 per employee per month. Benefits:

- Integrated Accounting Features: QuickBooks offers comprehensive accounting solutions, including invoicing, expense tracking, and financial reporting, suitable for small businesses.

- Easy Tax Preparation and Compliance: Simplifies tax filing and ensures compliance with automated tax calculations, deductions, and submissions.

QuickBooks Payroll integrates seamlessly with QuickBooks accounting software, providing a unified solution for financial management. It offers flexible plans with features like automated tax calculations, direct deposit, and same-day payroll, catering to a variety of business needs while ensuring accuracy and compliance in payroll processing.

Paychex Cost:

Their payroll services start at $39 a month plus $5 per employee per month for the Paychex Flex Essentials plan.Benefits:

- Comprehensive Payroll and HR Services: Paychex offers integrated payroll processing, tax services, and HR solutions, streamlining business operations.

- Customizable Employee Benefits: Provides a range of customizable employee benefits, including health insurance and retirement plans, enhancing employee satisfaction and retention.

Paychex offers a versatile range of services from payroll to HR and benefits administration, suitable for any business size. It features 24/7 support, a user-friendly platform, and robust tax compliance capabilities. Their scalable solutions grow with your business, making them a solid choice for long-term payroll management. Are you a one employee company? Click the link to learn more about PAYCHEX pricing for 1 employee.

Paycor Cost:

Paycor cost roughly $18-$26 a month to get started, however, for current plans and specials visit their website at the link below. Benefits:

- Streamlined HR and Payroll: Paycor offers integrated solutions for payroll, tax compliance, and employee management, simplifying complex processes for businesses.

- Intuitive User Interface: The platform’s user-friendly design and mobile accessibility enhance productivity by allowing easy management of HR tasks from anywhere.

Paycor offers a user-centric design that simplifies payroll and HR processes, with a suite of tools that enhance recruitment, onboarding, and employee management. It provides valuable insights through analytics, and its focus on small to medium-sized businesses ensures a tailored approach to payroll and HR solutions.

Rippling Cost:

Rippling starts at $8 a month, per user end it includes HR, IT, and finance software. Benefits:

- Unified Employee Management: Rippling centralizes HR, IT, and finance processes, streamlining employee data management across various systems.

- Automated Workflows: Automates key HR tasks like onboarding, benefits enrollment, and payroll, reducing manual effort and increasing efficiency.

Rippling excels in its ability to unify payroll, HR, and IT services, offering a comprehensive platform that simplifies employee management. It automates many administrative tasks, integrates with over 500 apps, and provides a unique feature to manage company devices, making it a standout choice for tech-forward businesses.

Gusto Cost:

Offers three main pricing plans: Simple ($40 per month + $6 per person), Plus ($80 per month + $12 per person), and Premium (contact Gusto for pricing). They also provide a subscription-free plan for businesses hiring only contractors and a free month-long trial for new customers. Benefits:

- Comprehensive Payroll Services: Gusto automates payroll, tax filings, and compliance, ensuring accuracy and saving time.

- Employee Benefits Management: Offers integrated management of health insurance, 401(k), and other employee benefits, streamlining enrollment and administration.

Gusto stands out for its intuitive design and user-friendly platform, offering a range of flexible plans to fit various business sizes. It integrates payroll with benefits and HR, provides excellent customer support, and its automated tax processing reduces errors, making it an ideal choice for modern, streamlined payroll management.

ADP Cost:

Pricing depends on the number of employees and the complexity of needs. The basic package is around $59 per month plus $4 per employee. Annually, for a 25 person company, the cost typically ranges from $2,000 to $4,000. The price increases with more frequent payroll runs. Learn more about ADP’s 3 month FREE trial, click here. Benefits:

- Extensive Payroll and HR Solutions: ADP provides a wide range of HR services, including payroll, tax, benefits, and compliance management, suitable for businesses of all sizes.

- Advanced Analytics and Reporting: Offers robust analytics and reporting tools, enabling informed decision-making and strategic HR management.

ADP offers scalable payroll solutions suitable for both small businesses and large enterprises. Its robust features include comprehensive tax compliance, HR tools, and a wealth of customizable payroll options. ADP’s global reach and expertise also ensure that businesses benefit from its extensive experience in the payroll sector.

Paycom Cost:

Paycom offers payroll outsourcing for around $25 a month and quote-based pricing, so the cost will depend on the specific services and features your business requires. Benefits:

- All-in-One HR Solution: Paycom consolidates payroll, HR, talent acquisition, and time and labor management into a single software system.

- Employee Self-Service Portal: Offers an intuitive self-service portal for employees to manage their own HR tasks, improving efficiency and reducing administrative workload.

Paycom provides a comprehensive, all-in-one payroll and HR solution, streamlining processes with its single software system. Its customizable features cater to specific business needs, ensuring a tailored approach to payroll management, and its user-friendly interface simplifies the complexities of employee data management.

SurePayroll Cost:

Offers a base payroll plan starting at $19.99 to $29.99 per month, plus a $4 per employee charge. Prices may vary depending on sales representatives. They also offer a 2-month free trial for small business customers. The app is free for employees of companies using SurePayroll for payroll. Benefits:

- Automated Payroll Processing: SurePayroll offers easy-to-use, automated payroll services, ideal for small businesses, with options for tax filing and compliance.

- Flexible Payroll Options: Provides a range of customizable payroll solutions, including various payment methods and schedules, catering to diverse business needs.

SurePayroll offers affordability with its low monthly base rate and per-employee fee structure, making it a cost-effective choice for small businesses. Additionally, its two-month free trial allows businesses to evaluate the service before committing, and the free mobile app enhances accessibility for both employers and employees.

What are the Benefits of Payroll Outsourcing?

Businesses that want to make their HR management processes better often find hiring outside help for payroll services useful, as it makes payroll systems work together more smoothly.

Specialized payroll services lower administrative costs and improve payroll accuracy.

This choice saves businesses money and allows them to work with payroll experts who make sure they follow tax laws and regulations, lowering risks and costs.

Outsourcing payroll tasks improves operational efficiency, allowing businesses to concentrate on core activities while gaining scalability and dedicated support. For a broader understanding of outsourcing benefits, see also: Compare HR Outsourcing Prices in 2026.

This helps organizations manage employee pay and benefits more effectively.

1. Time and Cost Savings

One of the primary benefits of payroll outsourcing is the significant time and cost savings that businesses gain.

Automating time tracking and payroll processing allows companies to redirect internal resources to more strategic tasks, enhancing overall administrative efficiency.

This change improves employee assignments and reduces payroll mistakes that can result in expensive fines.

Payroll specialists handle the complex tasks of tax compliance and reporting, allowing companies to concentrate on activities that promote advancement and creativity.

The financial efficiencies gained from outsourcing reduce overhead costs related to payroll management, allowing organizations to allocate their budgets more effectively and improve time efficiency.

In this competitive market, businesses can take a strong approach by using payroll outsourcing.

It ensures employees are paid correctly and on time, while also reducing the time spent on payroll tasks.

2. Compliance with Tax Laws and Regulations

Businesses find it important to follow tax laws and regulations, and payroll outsourcing greatly reduces their risk of non-compliance.

Payroll companies understand the latest tax laws, allowing them to calculate payroll taxes accurately and maintain exact records.

Payroll companies provide the skills that help businesses handle complicated legal requirements more confidently.

These providers keep up with changes in tax laws. This helps them file on time and lowers the chance of mistakes that could cause expensive fines.

Outsourcing payroll allows companies to concentrate on their main activities while assigning the responsibility of handling complex compliance tasks to experts who understand employment laws well, thus supporting business continuity.

This improvement makes our work more accurate and helps prevent audits and legal issues, keeping the business honest and successful.

3. Access to Expertise and Technology

Companies that hire external payroll services gain access to experienced payroll professionals and up-to-date technology tools.

This access improves payroll processing speed and offers helpful data analysis for HR management decisions.

Advanced payroll software simplifies handling boring administrative work, allowing organizations to concentrate on their main activities.

Payroll experts help companies follow complicated rules and reduce the chances of costly legal mistakes.

The combination of human knowledge and technology enables organizations to make informed decisions about managing their employees, aligning with their long-term goals.

This method helps companies make the most of their resources, improve employee happiness with fast payroll services, and support business growth.

4. Reduced Risk of Errors and Penalties

Outsourcing payroll significantly reduces the risk of errors and potential penalties arising from compliance failures.

Dedicated payroll solutions help businesses achieve higher payroll accuracy and maintain up-to-date records that safeguard against costly mistakes.

This plan lowers the risk of compliance issues and improves how we handle data.

Knowledgeable providers help organizations meet all regulatory requirements carefully and thoroughly. Consequently, the risk of inaccuracies diminishes, and the focus shifts towards more strategic activities within the company.

Automatic systems allow businesses to gather real-time data, making payroll processing easy and ensuring employees are paid correctly and on time.

Outsourcing creates a steady payroll system and improves a company’s ability to handle labor laws easily.

What are the Factors that Affect Payroll Outsourcing Cost?

Various factors determine how much you pay for payroll outsourcing, which in turn affects your total spending on payroll services. Knowing these details helps you look at costs carefully, which can help you get better offers from your chosen payroll provider. For deeper insights, you can compare HR outsourcing prices in 2026 as highlighted in our related insight: Compare HR Outsourcing Prices in 2026.

1. Number of Employees and Payroll Reporting

The number of employees in your organization directly influences the cost per employee when outsourcing payroll. Larger companies may benefit from economies of scale, while smaller businesses might see a higher cost ratio.

Payroll service providers often offer tiered pricing models that favor larger firms; as the workforce increases, the cost per individual employee usually decreases.

More employees allow these organizations to negotiate for lower costs and often benefit from a wide range of payroll services that can grow with their needs, enhancing strategic planning.

Big businesses realize that ongoing help and targeted HR services are more cost-effective. This approach simplifies their tasks and allows them to concentrate on core business functions while gaining better control over their payroll tasks.

2. Complexity of Payroll Process and Payroll Tax Obligations

The complexity of your payroll process significantly influences outsourcing costs and vendor selection. Companies with complex payroll systems often face higher service costs due to the increased risk of compliance issues, wage calculations, and detailed reporting needs.

This difference arises from the need for specialized knowledge to manage the various rules and requirements of complex payroll systems. For many businesses, especially those with workers from various backgrounds or places, knowing payroll rules is important for keeping expenses under control.

Factors such as employee classifications, tax obligations, and benefit structures all contribute to overall complexity. Therefore, managing these elements effectively may require custom outsourcing solutions, which can increase costs if not planned for correctly.

Checking payroll details thoroughly helps organizations plan for outsourcing, saving money while staying compliant and accurate.

3. Frequency of Payroll Processing and Payment Cycles

The frequency of payroll processing critically impacts outsourcing costs. Businesses that run payroll more frequently may encounter different pricing structures and payment processing options.

For instance, companies that choose a weekly payroll cycle often experience higher fees due to increased administrative tasks and the need for more frequent calculations.

Conversely, companies opting for a bi-weekly or monthly pay schedule may save money and simplify processes. This strategy helps them align their payroll processes with cash flow management and smooth operations.

Different payment methods, like direct deposit and paper checks, impact expenses and help manage cash flow.

By focusing on these factors, companies can select a payroll schedule that meets employee expectations and aligns with their financial goals.

4. Additional Services Needed and Customer Support

Additional services required beyond basic payroll processing also influence outsourcing costs. Customizable payroll solutions that offer employee self-service options or specialized training and support may incur higher fees.

Think about how these extra services can greatly improve the employee experience and make services more personalized.

Providing options such as simple access to pay statements, different direct deposit methods, and effective onboarding programs helps companies create a more satisfied and efficient workforce. Investing in these additional services typically results in higher retention rates and improved morale, offsetting the initial outsourcing expenses.

Employers who work on these improvements can create a more supportive workplace, leading to better financial results.

What are the Average Costs of Payroll Outsourcing?

Knowing the typical expenses of payroll outsourcing aids businesses in budgeting and assessing their options to confirm vendor trustworthiness.

Costs vary for small, medium, and large companies, but a clear plan helps businesses make well-informed choices.

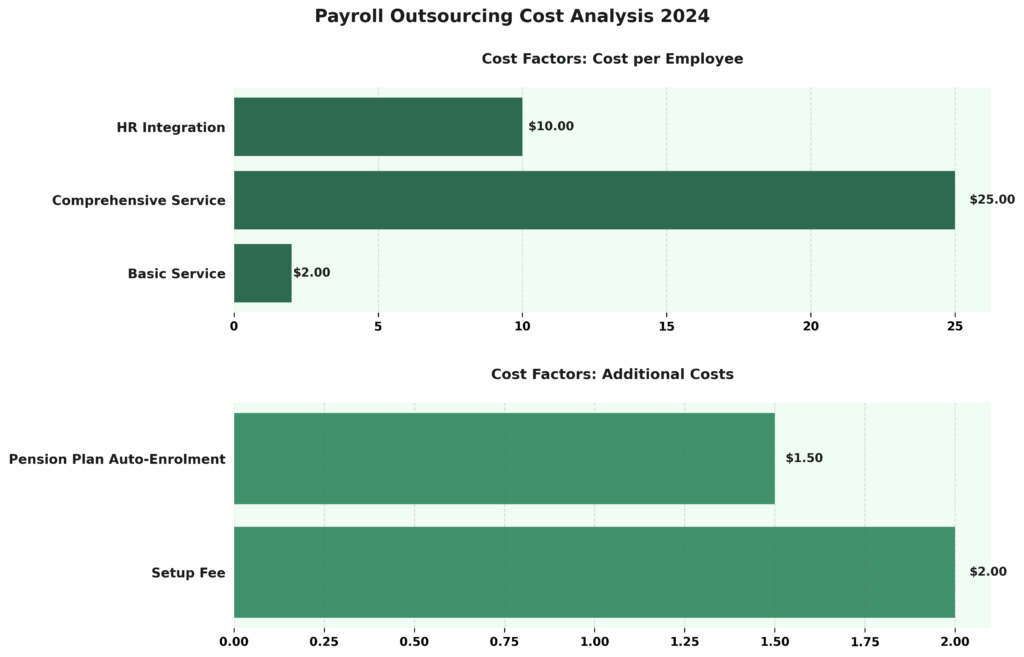

Payroll Outsourcing Cost Analysis

The Payroll Outsourcing Cost Analysis provides information on the main expenses that affect companies when they hire external payroll services. Knowing these elements, including the advantages of outsourcing, helps companies reduce expenses and maintain smooth and dependable payroll handling.

Cost Factors detail the primary expenses businesses incur when outsourcing payroll. The analysis highlights different service levels and additional charges that can affect the overall cost structure.

- Cost per Employee: This includes labor costs and business efficiency considerations.

- Basic Service: At $2.00 per employee This service handles basic payroll tasks, providing an affordable choice for small businesses or those with simple payroll requirements.

- Comprehensive Service: Priced at $25.00 per employee This service offers more detailed payroll management, including tax filings and compliance, which are important for larger businesses or those with complicated payroll needs.

- HR Integration: Adding HR integration incurs an additional $10.00 per employee This shows the benefit of making payroll processes more efficient and connecting them with overall HR tasks.

- Additional Costs:

- Setup Fee: A one-time charge of $2.00 The initial setup includes system configuration and onboarding, which is an upfront cost to make sure payroll runs smoothly.

- Pension Plan Auto-Enrolment: For $1.50, this service facilitates automatic enrollment in pension schemes, ensuring compliance with legal requirements and supporting employee benefits management.

The analysis of payroll outsourcing costs enables businesses to make informed decisions about service levels and additional features that align with their operational needs and budget constraints. By offering both basic and complete services, companies can improve how payroll is handled, follow rules, and keep employees happy while keeping expenses in check.

1. Small Businesses

When considering small business payroll, evaluating specific needs and potential cost savings of outsourced payroll solutions becomes important.

Small businesses face significant variations in payroll outsourcing costs based on employee numbers and specific service needs. Knowing these costs helps you make a good budget and evaluate return on investment.

Things like how complicated payroll is, how often payments are made, and adding services like handling taxes and managing benefits can greatly affect payroll processing costs.

Many small business owners may not realize that outsourcing automation leads to significant time savings, better employee management, and reduced compliance risks.

When companies outsource payroll tasks to specialists, they simplify their work processes and free up important resources to focus on expansion and improving customer service.

Outsourcing enables smaller companies to access advanced technology and skills that might be too expensive to obtain independently, improving operational efficiency and enhancing service quality.

2. Medium-Sized Businesses

Medium-sized businesses must consider service provider fees as part of their overall cost evaluation.

Medium-sized businesses often experience different average costs for payroll outsourcing compared to small firms. Their unique operational efficiency needs and employee count can significantly influence these costs.

These organizations usually have a more complicated payroll system that involves many employees with different jobs, benefits, and tax considerations. Factors such as the choice of payroll service provider, the level of customization required, and the frequency of pay cycles all contribute to the overall expense.

By choosing to outsource, medium-sized businesses effectively reduce these problems. This enables experts to manage detailed tasks, allowing internal resources to focus on other priorities. Simplifying payroll tasks can improve productivity and save money, allowing the business to concentrate on its main goals and growth prospects.

3. Large Businesses

Big companies need to carefully evaluate the advantages and disadvantages when choosing outsourcing partners.

Large businesses typically achieve favorable pricing structures by outsourcing payroll and benefiting from economies of scale.

High employee counts often enable large businesses to negotiate better service agreements.

This can lead to big savings on payroll processing costs, ranging from hundreds to thousands of dollars each month, depending on the level of difficulty and the services needed.

Larger firms often face diverse payroll needs due to their varied workforce, which enables them to further customize their outsourcing solutions. This adjustments can include customizing reports, managing compliance, and offering specific services that fit business needs.

These benefits increase productivity and profits.

How Can Businesses Reduce Payroll Outsourcing Costs?

To reduce payroll outsourcing costs, businesses must understand outsourcing trends and implement strategic measures.

Businesses can reduce payroll outsourcing costs by using various methods that improve operations and eliminate extra expenses.

Companies can simplify payroll tasks and negotiate better deals with service providers to reduce spending.

1. Streamline Payroll Processes

Making payroll tasks easier can greatly improve how effectively work is done and lower overall costs. Using payroll software and automation tools enables faster processing and reduces errors.

When organizations use advanced technology, they can automatically handle routine tasks like data entry, calculations, and compliance updates. This saves HR professionals time, enabling them to concentrate on strategic projects.

These solutions often feature real-time data analytics, helping management understand payroll patterns and workforce expenses, which improves business intelligence.

Modern payroll systems include strong security features that reduce risks like data breaches and unauthorized access. This ensures employee data is protected, keeping important information safe and building trust with staff.

Using these new ideas makes payroll easier and supports a business that can quickly adjust to changes, improving how things run.

2. Negotiate Fees with Service Providers

Talking about fees with service providers is important for reducing payroll outsourcing expenses. Involvement in contract talks and knowing service level agreements can help businesses find hidden costs and get better deals.

To handle these discussions effectively, businesses must understand market standards and what others in the industry provide before starting negotiations, ensuring due diligence.

A provider’s replies and readiness to adjust terms show useful information about their pricing details. Clear pricing builds trust and enables businesses to make informed choices about the services they select.

Make sure to ask about any extra charges that might come up after signing the contract, as knowing these details can greatly affect the total cost. Keeping open discussions builds a strong partnership.

3. Choose a Package with Customizable Services

Choosing a payroll package with customizable services allows businesses to tailor their outsourcing experience to fit specific needs. With this plan, businesses pay only for additional services that are essential.

Focusing on the features that matter most enables organizations to significantly minimize unnecessary costs. This also enhances productivity.

Custom payroll options let businesses change how they manage payroll as they grow or their needs shift. This makes tasks easier and helps use resources better by focusing them where they are truly needed.

Choosing the correct package supports following rules, lowers the chance of errors, and makes employees happier. Tailoring these services enables businesses to stay competitive while maximizing their investment in payroll management.

4. Consider In-House Payroll Options

Looking into handling payroll internally can be a good choice for companies wanting to spend less on outside services. Carefully examining costs helps determine if managing payroll internally leads to better budgeting and accurate payroll processing.

Managing payroll internally grants companies greater control over their finances, enabling customized solutions that meet specific business requirements and improving vendor management.

This independence simplifies communication between departments and builds employee confidence, as familiar personnel manage payroll, enhancing overall employee management.

Realizing that managing tasks within the organization can need a lot of money and employees to follow frequently changing regulations is essential. Smaller companies often find handling payroll difficult. Companies should seriously consider the advantages and disadvantages of managing payroll themselves versus hiring an external service.

Payroll Outsourcing FAQ’s

Navigating the complexities of payroll can be daunting for businesses, as the costs involved are influenced by a myriad of factors, from employee count to the intricacies of tax regulations. Understanding the determinants of payroll expenses is crucial for efficient financial management. This concise guide aims to demystify the pricing structures of payroll services and software, offering insights into cost-saving strategies, outlining the core services of outsourced payroll, and addressing common queries. Armed with this knowledge, businesses can make informed decisions, ensuring their payroll processes are both cost-effective and compliant with regulatory demands.

When considering the cost of payroll services and software, several factors come into play:

- Number of Employees: Providers typically charge per employee, so the more staff you have, the higher your costs will be.

- Payment Frequency: If you run payroll weekly, it will cost more than running it bi-weekly or monthly due to the increased number of transactions.

- Service Features: Basic services are cheaper but adding on features like tax filing, direct deposit, or access to a human HR advisor will increase costs.

- Integration Needs: If you need the payroll service to integrate with your existing systems (like HR or accounting software), this can add to the cost.

- Geographical Location: Taxes and compliance requirements can vary by location, potentially impacting cost.

- Industry-Specific Requirements: Certain industries have unique payroll needs that might require more expensive, specialized services.

How Can I Reduce Online Payroll Costs?

- Reevaluate Your Needs: Only pay for the services you need. If you’re paying for features you don’t use, consider downgrading your plan.

- Consolidate Providers: Using one provider for payroll, HR, and benefits could be cheaper than using several separate services.

- Automate Where Possible: Using software to automate processes can reduce the need for manual entry and oversight.

- Negotiate Pricing: Some providers may offer discounts if you commit to a longer contract or have a large number of employees.

What Services Are Included in Payroll Outsourcing?

- Calculating payroll and tax obligations

- Filing and paying payroll taxes

- Issuing paychecks and direct deposits

- Managing new employee onboarding from a payroll perspective

- Generating reports for accounting and compliance

- Providing employee access to pay stubs and end-of-year tax documents

- Handling wage garnishments

Some other frequently asked payroll questions include:

- How secure is the payroll service? Security is crucial since payroll services handle sensitive financial data.

- What kind of customer support is offered? Good support can be essential, especially for complex payroll issues.

- Is the service scalable? As your business grows, you’ll want a service that can grow with you.

- How does the service stay compliant with tax laws? The service should update automatically with changes in tax legislation to keep you compliant.

Without the ability to view your uploaded image, I’ve addressed the textual questions you’ve posed. If the image contains specific questions about payroll service and software costs or if you need assistance with information related to the image, please let me know how I can assist further.

RELATED ARTICLES: